Multi-leg Strategies

Debit Spread

A debit spread involves buying and selling options of the same type (call or put) with the same expiration date but different strike prices. It’s called a "debit" spread because it requires you to pay a net premium to create the strategy. Debit spreads can use call options (bullish) or put options (bearish), depending on the investor’s outlook.

- Outlook: Bullish if using call options; Bearish if using put options

- Use: Primarily used when attempting to profit from small movements in the price of the underlying stock

- Profit: If using call options, you’ll profit if the stock price rises above the breakeven price. If using put options, you’ll profit if the stock price falls below the breakeven price

- Loss: For call options, you’ll incur losses if the price of the underlying asset doesn't rise sufficiently to cover the net premium paid. For put options, you’ll incur losses if the price does not fall sufficiently to cover the net premium paid

Risks

Debit spreads provide a defined risk-reward profile and provide controlled exposure to underlying price movements. While your maximum loss is capped at the net premium paid, there is still the risk that your short option position may be assigned.

Basic example

Let’s say that you believe there will be a small upward price movement for FlyFit over the coming months. FlyFit is trading at $100 so you purchase a call option with a $102 strike price for a $3 premium and you sell a call option with a $110 strike price for a $1 premium. This debit spread is often called a bull call spread.

- Strike price: $102 Long, $110 ShortStrike price represents the price you’d pay if you were to exercise your long call or the amount you’d receive if your short call were to be assigned

- Contract price: $3 Long, $1 ShortPer-share price of the option contracts

- Total cost: ($3 - $1) x 100 = $200Options have a contract multiplier, or the number of shares presented. Total cost is the cost to purchase the lower strike call option ($3), less the premium collected for selling the higher strike call option ($1), multiplied by the contract multiplier. There may be add’l fees charged by your Brokerage

If you exercise the long call option, you’d purchase 100 shares for a total of $10,200. If you get assigned on the short call option, you’d deliver 100 shares and receive $11,000.

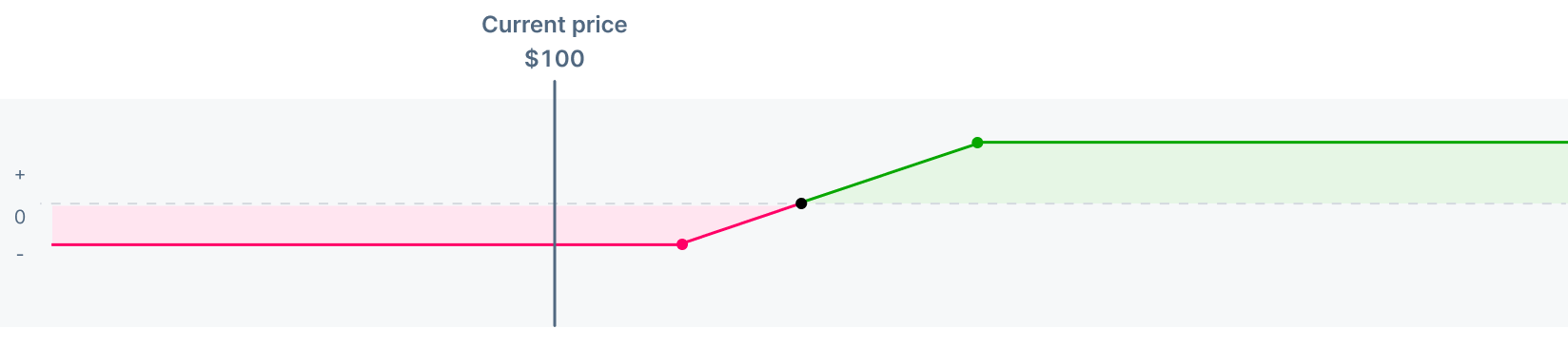

Maximum profit and loss

The P/L calculations take into consideration both the long call position and the short call position.

- Max loss: $200The maximum loss of a debit spread is the net premium paid. In the case of a call debit spread, the amount you paid for the lower strike call less the premium you collected for the higher strike call

- Breakeven: $104The breakeven is equal to the lower strike price + net premium paid, or the total premium paid - premium received

- Max profit: $600Higher strike price (short) - lower strike price (long) - net premium paid

The max profit is capped and can be obtained at a stock price of $110 or higher. Above $110, the profit does not continue increasing.

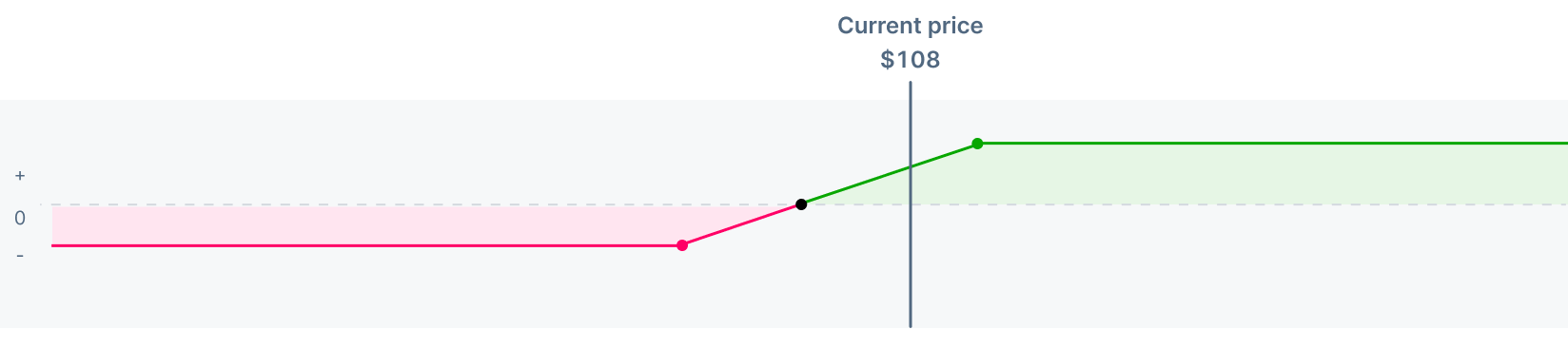

Profit if...

FlyFit’s stock price is above the breakeven.

- Total profit: ($108 - $102 - $2) x 100 = $400The minimum of the current price and higher strike price, less the lower strike price and net premium paid

If FlyFit's stock price rises above the $104 breakeven, the call option becomes more profitable than the net premium paid for the strategy. The strategy continues to earn more until the higher strike price of $110 is reached, at which point, the max profit is captured.

If the price continues rising above $110, the short call option becomes in-the-money, and is likely to be assigned. You no longer continue benefiting from the stock price rising as the stock you’d acquire for $102 would be sold for $110, when your short call was assigned.

If the price continues rising above $110, the short call option becomes in-the-money, and is likely to be assigned. You no longer continue benefiting from the stock price rising as the stock you’d acquire for $102 would be sold for $110, when your short call was assigned.

Loss if...

FlyFit’s stock price does not rise high enough to offset the net premium paid.

- Total loss: ($103 - $102 - $2) x 100 = $100Cost of the options is the maximum loss assuming the price does not trade in-the-money.

In the scenario above, you’d purchase 100 shares of FlyFit for $102, or $10,200. This would result in a gain of $100, but since the call options originally had a net cost of $200, the overall trade results in a net loss of $100.

If the price of FlyFit drops below $102, both options remain out-of-the-money and expire worthless. As a result, the strategy loses the net premium paid for the two call options, but cannot lose more.

If the price of FlyFit drops below $102, both options remain out-of-the-money and expire worthless. As a result, the strategy loses the net premium paid for the two call options, but cannot lose more.

Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

Options resource center

Options Foundations

Fundamentals

Multi-leg Strategies

Chapter 14Long straddle

Chapter 14Long straddle Chapter 15Long strangle

Chapter 15Long strangle Chapter 16Debit spread

Chapter 16Debit spread Chapter 17Credit spread

Chapter 17Credit spread Chapter 18Calendar spread

Chapter 18Calendar spread