Discover all you need to know about Municipal Bonds, where local impact meets tax advantages with this detailed guide. Before we begin, its important to note that while this information is intended as a general educational resource, Public Investing does not provide tax advice. For personalized guidance related to your specific situation, it is advisable to consult your tax advisors.

Municipal Bonds: Investing Locally and the Tax Advantages

Table of Contents

What are Municipal Bonds?

Municipal bonds, also known as munis, are debt securities usually issued by state and local governments to fund public projects. Investors purchase these bonds, effectively lending money to the government, and receive interest payments and the bonds face value at maturity. Munis are generally favored by investors for their potential tax benefits compared to corporate bonds. This was underscored in Moodys Investors Services yearly overview of the municipal bond market, which covers U.S. municipal bond defaults and recoveries from 1970 to 2021, with additional updates extending into 2023. They serve to diversify portfolios and help finance essential projects like schools and infrastructure. Nevertheless, its important to keep in mind that past performance does not guarantee future results.

Municipal bonds differ from other types of bonds primarily in their tax treatment. The interest income generated from municipal bonds is generally exempt from federal income taxes, and state and local taxes in some cases, making them attractive to investors in higher tax brackets. However, municipal bonds typically yield lower returns compared to corporate bonds. While municipal bonds are used to fund public projects and services, corporate bonds represent debt issued by for-profit companies.

Independent rating agencies like Moodys, S&P Global, and Fitch Ratings typically assign credit quality ratings to municipal bonds. These agencies evaluate various factors to assign ratings, including the issuers financial health, economic conditions, and bond terms. Ratings range from A to D, with AAA being the highest rating that indicates the lowest default risk.

Ratings are not investment recommendations and may not match an investors risk preferences. Ratings are just one factor to consider; its essential to conduct thorough due diligence before investing.

Types of Municipal Bonds

Municipal bonds are classified according to the origin of their interest payments and principal repayments. They fall into two primary categories:

-

General Obligation Bonds: These bonds are backed by the creditworthiness of the issuing government entity, such as a city or county. They are supported by the issuer’s ability to levy taxes and are not tied to a specific revenue source. An example would be a city issuing general obligation bonds to fund public infrastructure projects like schools or parks.

-

Revenue Bonds: They are secured by specific revenue streams such as tolls, user fees, or lease payments generated by the project or facility they finance. They do not rely on the issuer’s general funds or taxing power. An example of a revenue bond is one issued to finance the construction of a toll bridge, where the bond repayment depends on the toll revenue collected from bridge users.

Benefits of Investing in Municipal Bonds

While not without risks and the principal is not guaranteed, investing in municipal bonds may provide a means to help preserve capital while earning interest. Here are some benefits you can expect:

-

Diversification for Portfolios: Historically, municipal bonds have shown a low correlation with stocks, which means they might offer a way to diversify portfolios. For example, adding municipal bonds to a stock-heavy portfolio may possibly add stability to a portion of the portfolio. It’s, however, important to keep in mind that diversification does not guarantee profits or protect against losses.

-

Interest: Municipal bonds have traditionally been associated with consistent interest payments. While interest is a benefit of municipal bonds, investors should conduct thorough research and consider market risks before investing.

Understanding Tax Advantages of Municipal Bonds

-

Federal Income Tax Exemption: Municipal bonds offer investors the potential for tax benefits through federal income tax exemption. Generally, these bonds may shield investors from federal taxes on interest income. However, it’s essential to note that they may still incur state taxes if purchased from a state other than the investor’s residence. Additionally, capital gains taxes can apply if bondholders realize gains when selling their bonds, especially if they were initially bought at a discount on the secondary market and then redeemed.

-

State and Local Benefits: Municipal bonds issued within an individual’s home state are generally exempt from federal taxes and are often free from state/ local taxes. However, if these bonds are acquired from a different state, they may still be subject to state taxes, depending on the investor’s residence. Exceptions to this tax advantage can occur if the investor’s state enforces taxes on municipal bond interest from out-of-state issuers.

While investing in municipal bonds from your own state may provide tax benefits, there can be reasons to consider purchasing bonds from other states. If you reside in a state with minimal or no state income tax, diversifying your municipal bond portfolio with issuers from different states may be advantageous. Additionally, some out-of-state municipal bonds may offer superior yields, even when factoring in state income taxes. Thorough research from investors is recommended before making investment decisions. -

Alternative Minimum Tax: While municipal bond interest is generally tax-exempt, some investors may be subject to the Alternative Minimum Tax (AMT). It’s important for the investors to check their AMT status before investing. The AMT operates as a separate tax system to ensure that affluent individuals pay a minimum federal tax even on otherwise tax-exempt income. Some municipal bonds, especially those financing projects like stadiums or airports, might fall into this category. If you hold such a bond and are required to pay AMT, your interest income may be taxed at the applicable AMT rate.

-

Tax Swaps: A tax swap in municipal bonds entails selling a bond that has incurred a capital loss while purchasing a similar bond to maintain the portfolio’s exposure. This strategic maneuver offers investors a potential means to manage capital gains and losses within their investment portfolio effectively.

-

Comparing Taxable and Tax-Free Yields: Tax-free municipal bond yields are usually lower than taxable bonds, but the choice depends on the investor’s tax bracket. For example, if a municipal bond yields 3% tax-free and an investor falls into the 25% tax bracket, they would need a taxable bond yielding 4% to achieve an equivalent after-tax return. This example assumes no fees or no state and local taxes. Generally, higher tax brackets may make tax-free bonds more attractive due to tax savings.

-

Taxable Equivalent Yield: The taxable equivalent yield calculation helps in making informed decisions by determining the yield a taxable bond must provide to match the after-tax return of a tax-free municipal bond, tailored to the investor’s tax bracket. This calculation serves as a valuable benchmark for assessing the tax efficiency of tax-free municipal bonds.

Risks of Investing in Municipal Bonds

Just like any other investment, municipal bonds carry their own set of risks. Lets take a look at them:

-

Credit Risk of the Issuer: Municipal bonds carry credit risk, where the issuer’s financial struggles or economic downturns can affect their ability to meet debt obligations. For instance, a city facing financial challenges may struggle to make interest payments.

-

Interest Rate Risk: Interest rate fluctuations can impact bond values, particularly long-term bonds. For example, A 10-year municipal bond with a 3% fixed interest rate may lose value if market rates rise to 4%, making it less attractive to buyers.

-

Market Risk: Bond market values can fluctuate due to economic conditions and investor sentiment. Example: Economic uncertainty can drive investors to bonds, raising prices, while economic growth may lead to bond price declines.

How to Invest in Municipal Bonds?

Various avenues catering to different preferences and levels of involvement are available for investing in municipal bonds. They include:

-

Bond Market Platforms: Investors can access municipal bonds through bond market platforms like brokers or online trading platforms. These platforms provide a marketplace where buyers and sellers can transact municipal bonds.

-

Municipal Bond Funds: Another option is to invest in municipal bond funds operated by professional portfolio managers. These funds pool money from various investors to buy a diversified portfolio of municipal bonds.

-

OTC Market: The over-the-counter or OTC market is another avenue for municipal bond investment. Investors can trade municipal bonds directly with dealers in this market. While it provides flexibility, it may require more market knowledge and research than traditional brokerage platforms.

-

Financial Institutions: Investors can buy municipal bonds directly from financial institutions such as banks and credit unions. These institutions may offer a selection of municipal bonds for purchase, often catering to individual investors.

Municipal bonds are vital in funding essential public projects and offering potential tax advantages to the bondholders. Potential investors must conduct thorough research and due diligence before investing in municipal bonds, as each investment has risks and considerations. Its important to consult with a financial advisor before making any investment decisions.

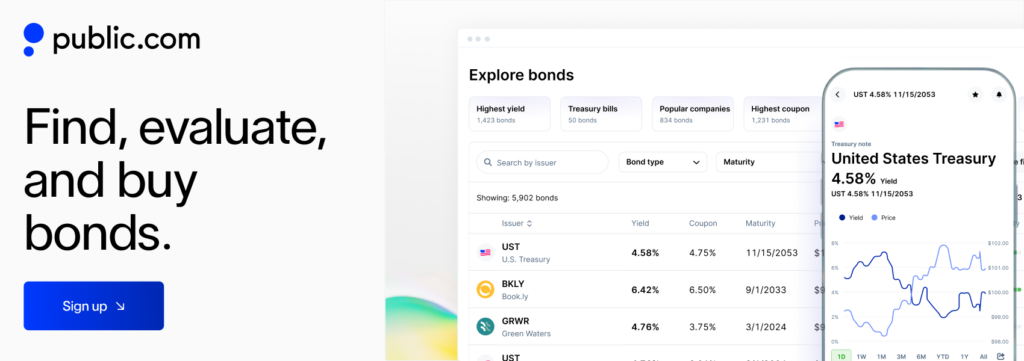

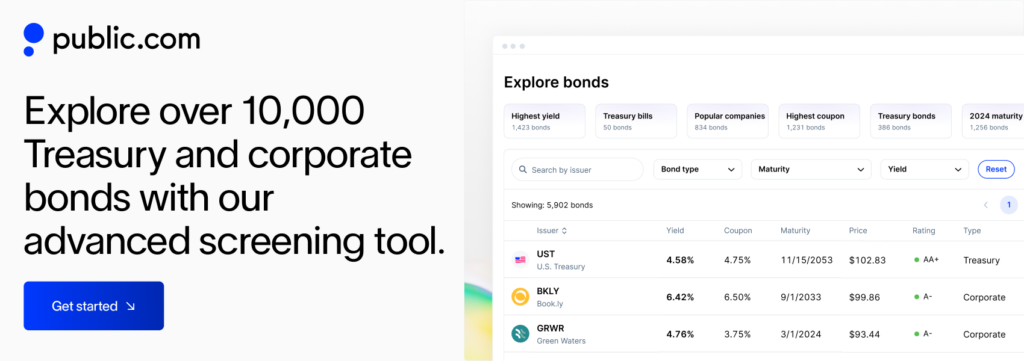

While Public.com does not offer municipal bonds at this time, it is an investment platform that provides access to a variety of other financial instruments. Sign up today to take charge of your financial future and start building a diversified portfolio.

FAQs

What are municipal bonds, and how do they work?

Municipal bonds are debt securities typically issued by state or local governments. Investors purchase these bonds, effectively lending money to these governmental entities in return for regular interest payments and the eventual return of the principal at maturity. They’re often used to finance public projects like infrastructure and schools. However, not all munis fund public endeavors. Investors should research specific bonds or consult with a financial advisor to understand their exact use and associated risks.

Are the interest earnings from municipal bonds truly tax-free?

Generally, interest income from municipal bonds is exempt from federal income tax. State and local tax exemptions may also apply depending on your residence. Interest from municipal bonds may be subject to taxation in some cases.

How can I purchase municipal bonds?

You can buy municipal bonds through brokers, online platforms, financial institutions, or the OTC market. Although Public.com doesn’t currently provide municipal bonds, it offers access to various other financial instruments on its investment platform.

How often do municipal bonds pay interest to investors?

Fixed-rate municipal bonds provide semiannual interest payments (usually on June 30 and December 31 each year), although some may follow different payment schedules, including annual payments.

Can you sell municipal bonds before they mature?

Yes, municipal bonds can be sold before their maturity date in the secondary market. This offers liquidity and the potential to capture gains or losses. While municipal bonds can be sold before their maturity date in the secondary market, it’s important to note that liquidity in these bonds is not guaranteed. Investors should anticipate holding until maturity.