Navigating the investment world often boils down to choices, and one of the most fundamental decisions is between stocks and bonds. Both have their merits, but understanding their distinct characteristics can illuminate the path to building a balanced portfolio.

Stocks or Bonds: Which is Right for You?

Table of Contents

Introduction

In the vast realm of investing, stocks and bonds stand as two pillars that have long attracted the attention of those looking to grow their wealth. Stocks represent ownership in a company, with a potential for profits through share price appreciation and dividends. Bonds, on the other hand, are akin to loans made by investors to issuers, typically offering periodic interest payments and the return of the principal amount at maturity. While both can be integral components of a diversified portfolio, discerning their differences and understanding how they respond to market dynamics is crucial for any investor. This article delves into the nuances of stocks and bonds, aiming to provide clarity for those contemplating their investment choices.

What are Stocks?

Stocks, often referred to as shares or equities, represent ownership in a company. When you buy a stock, youre purchasing a piece of that company, making you a shareholder.

How do stocks make money?

Stocks can generate returns in two primary ways: through appreciation in share price and, in some cases, through dividends. For example, if you purchase a stock at $50 and its price rises to $60, youve made a $10 profit per share upon selling. Additionally, some companies distribute a portion of their earnings to shareholders in the form of dividends, providing another potential source of income. It is also essential to note that all investments carry risks, and there are no guarantees of returns or profits.

What are Bonds?

Bonds are debt securities. When you purchase a bond, youre essentially lending money to the issuer, be it a corporation, municipality, or government. In return, the issuer agrees to pay you periodic interest and return the principal amount at the bonds maturity.

How do Bonds make money?

Bonds generate income through interest payments, often referred to as the bonds coupon rate. For instance, if you buy a bond with a face value of $1,000 and a 5% annual coupon rate, youll receive $50 each year in interest. Additionally, if you purchase the bond below its face value and hold it to maturity, youll also benefit from the difference between the purchase price and the face value. It is, however, essential to note that all investments carry risks, and their returns are not guaranteed.

Stocks vs. Bonds: Key Differences

Navigating the investment landscape requires a clear understanding of the tools at ones disposal. Stocks and bonds, while both avenues for potential growth, come with distinct characteristics and implications for an investors portfolio. The table below outlines the fundamental differences between these two primary investment vehicles:

| Aspect | Stocks | Bonds |

|---|---|---|

| Nature of Investment | Ownership in a company. | Debt security; a loan to the issuer. |

| Return on Investment | Potential dividends and capital appreciation. | Periodic interest payments (coupon rate) and the return of principal at maturity. |

| Risk Level | Generally higher risk due to market volatility. | Typically considered lower risk than stocks, but still subject to credit, interest rate, and market risks. |

| Duration | Can be held indefinitely, if the company is publicly traded; however, they can be delisted or affected by company acquisitions. | Have a fixed maturity date. |

| Income Generation | Possible dividends, but not guaranteed. | Regular interest payments, typically semi-annually or annually. |

| Effect of Interest Rates | Indirect effect. Rising rates might make borrowing costly for companies, potentially affecting stock prices. | Direct effect. Bond prices move inversely to interest rates. |

| Liquidity | Generally high for publicly traded companies. | Varies. Some bonds, like U.S. Treasuries, are highly liquid, while others might be less so. |

| Tax Considerations | Dividends and capital gains might be subject to taxes. | Interest from certain bonds, like municipal bonds, might be tax-exempt at the federal or state level. |

| Influence on Issuer | Shareholders might have voting rights in company decisions. | Bondholders don’t have voting rights but have a claim on assets if the issuer defaults. |

Which is better: Stocks or Bonds?

The decision between stocks and bonds is not a matter of one being universally better than the other. Instead, its about understanding the pros and cons of each and determining which aligns more closely with your individual financial goals, risk tolerance, and investment horizon. Lets delve into the advantages and potential drawbacks of each:

Advantages of Investing in Stocks

-

Growth Potential: Historically, stocks have offered a higher potential for long-term growth compared to bonds, due to higher risk exposure. It is, however, important to note that past performance is not indicative of future results.

-

Dividend Income: Some stocks may provide the opportunity for regular dividend payments, offering an additional income stream. However, dividend payments are not guaranteed and depend on the company’s financial health and dividend policy.

-

Liquidity: Stocks of publicly-traded companies are generally considered to be liquid, meaning they can be bought or sold relatively easily.

-

Ownership and Influence: Holding stocks gives shareholders a stake in the company, which often comes with voting rights on certain company matters.

Drawbacks of Investing in Stocks

-

Volatility: Stocks can be highly volatile, leading to potential short-term losses.

-

No Guaranteed Returns: Unlike bonds, which typically promise regular interest payments, dividends from stocks aren’t guaranteed.

-

Complexity: The stock market can be complex, requiring research and understanding to navigate effectively.

Advantages of Investing in Bonds

-

Steady Income: Bonds typically provide regular interest payments, offering a predictable income stream. But this depends on the financial condition of the issuer. There is always a risk of default, where the issuer may be unable to make interest or principal payments when due.

-

Lower Volatility: Bonds are generally considered less volatile than stocks, making them a more stable investment in the short term.

-

Diversification: Bonds can offer diversification benefits to a portfolio, especially during stock market downturns. However, it’s important to note that diversification does not eliminate risk or guarantee positive returns.

-

Principal Repayment: At maturity, bondholders are typically repaid the bond’s face value, offering a level of capital preservation.

Drawbacks of Investing in Bonds

-

Interest Rate Sensitivity: Bond prices can be sensitive to changes in interest rates. When rates rise, bond prices may fall, and vice versa.

-

Credit Risk: There’s a risk that the bond issuer might default on interest or principal payments.

-

Lower Growth Potential: Over the long term, bonds might offer lower returns compared to stocks.

In conclusion, both stocks and bonds come with their set of advantages and potential challenges. The key is to understand these aspects in the context of your financial objectives and risk appetite.

How do I Buy Stocks?

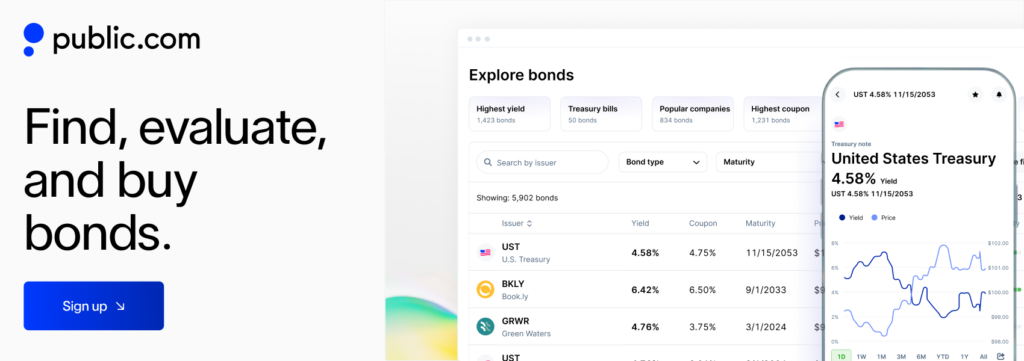

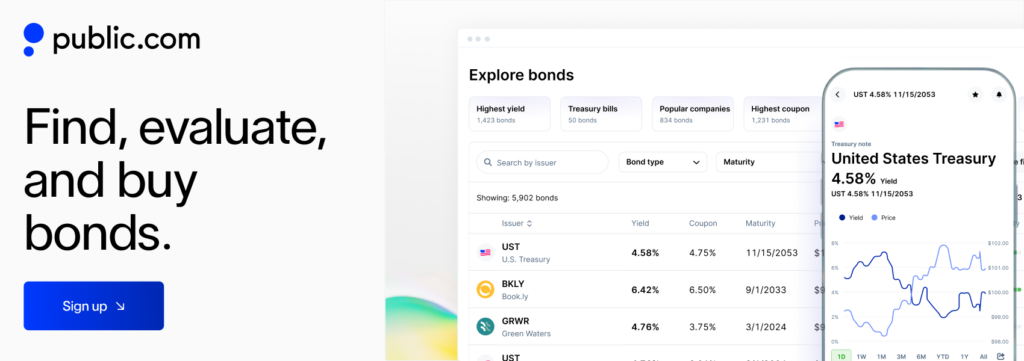

Investing in stocks begins with choosing the right platform that aligns with your financial goals and needs. Platforms like Public.com have simplified this process, allowing both newcomers and seasoned investors to easily buy and sell shares. Once registered, users can explore a vast array of stocks, make informed decisions using integrated research tools, and execute trades. Beyond the basics, Public.com offers advanced features tailored for the modern financial landscape. Extended hours trading lets investors act outside traditional market hours, while instant deposit and withdrawal functionalities ensure seamless fund management. Operating as a PFOF (Payment for Order Flow) free broker, Public.com emphasizes transparency, ensuring trades are executed without hidden costs.

With these tools and features, investing in stocks becomes a more streamlined and transparent process. Ready to embark on your investment journey? Join Public.com today and be part of a community that values informed investing. As always, its essential to conduct thorough research and consider seeking advice from financial professionals before making investment decisions.

How do I Buy Bonds?

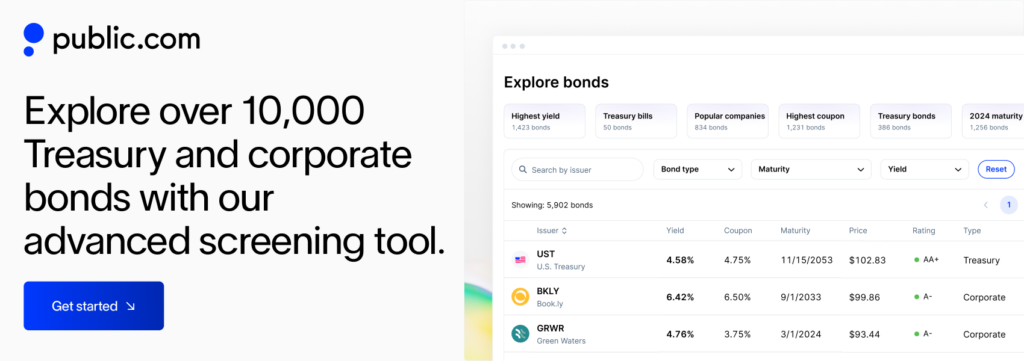

Many online brokers, including Public.com, offer platforms that facilitate the trading of both corporate and municipal bonds, allowing transactions in new issues directly from the issuing entity or in secondary markets from other investors. For those with an interest in Treasury securities, they can be accessed through platforms like the Treasury Direct website. On the other hand, bond exchange-traded funds (ETFs) and bond mutual funds have become prominent instruments in the investment landscape. These funds pool resources from multiple investors to engage in bond transactions. Each fund typically operates with an expense ratio, covering operational costs. Investors can select from a variety of these funds based on their individual preferences or the specific type of bonds they wish to be exposed to. Public.com offers an extensive selection of over 10,000+ corporate, Treasury, and municipal bonds. Our platform enables investors to select bonds based on key characteristics like yield, maturity, and rating, thereby facilitating informed and strategic investment decisions.

Conclusion

Navigating the investment landscape requires understanding the unique attributes of both stocks and bonds. While stocks offer potential growth and company ownership, bonds provide a more predictable income stream and stability. However, its essential to note that investors dont have to choose exclusively between the two. A balanced portfolio can incorporate both, leveraging the strengths of each to achieve diversified growth and risk management. Recognizing this, we invite you to explore our new bond screener, where you can filter and choose bonds based on specific criteria like yield, maturity, and rating, allowing for a more personalized investment strategy. Begin your journey in bond investment with Public today, and align your portfolio with your individual goals and risk preferences.

As always, aligning choices with individual goals and risk tolerance is paramount. Consider thorough research or consultation with financial professionals before making any investment decisions.

FAQs

1. What's the primary difference between stocks and bonds?

Stocks represent company ownership, often with voting rights. Bonds are debt securities, where investors loan money to an issuer for interest payments and bond’s face value return at maturity. For those interested in diversifying their portfolio, Public.com offers a user-friendly platform to invest in both stocks and bonds along with other asset classes.

2. Can I expect higher returns from stocks or bonds?

Historically, stocks have shown potential for higher returns but with increased volatility. Bonds offer more predictable returns but might have lower long-term growth. To balance this out, why not check out the bond options on Public.com? They’re a great way to add stability to your investment portfolio.

3. How do interest rates affect stocks and bonds?

Interest rates influence stock prices indirectly through company borrowing costs. For bonds, rising rates typically lower bond prices, and vice versa.

4. Why diversify between stocks and bonds?

Diversifying helps manage portfolio risk. While stocks offer growth, they’re volatile. Bonds, being relatively more stable, can offset market downturn impacts.

5. Which is riskier: stocks or bonds?

Stocks generally have higher volatility, making them riskier in the short term. Bonds, while more stable, carry risks like interest rate changes.

6. How do dividends from stocks differ from interest from bonds?

Dividends are company profit shares given to stockholders. Bond interest is a predetermined payment to bondholders for loaning money. This fixed income component from bonds is something you can explore through our bond offerings.