We're the only investing platform that gives you a rebate on every options trade.

Our rebate means that each options contract costs less than zero. You actually earn money.

| Broker | Rebate | Fees |

|---|---|---|

| Earn up to $0.18per contract traded< | $0.03 | |

| Robinhood | None | $0.03 |

| Fidelity | None | $0.67–$0.69 |

| TD Ameritrade | None | $0.66 |

Trading fees for competitors were taken from their website on 4/19/2024, and are exclusive of promo rates. The trading fees above are an approximation, are subject to change, and may vary based on factors such as the total number of contracts and price per contract. See terms & conditions for enrolling in Public's options rebates at public.com/disclosures/rebate-terms

Have questions? Find answers.

How much does it cost to trade options on Public?

Unlike many other investing platforms, we don’t charge commissions or per-contract fees when you place an options trade. What’s more, you receive a rebate of $0.06–$0.18 per options contract traded. That means you pay less for every contract you purchase and earn more for every contract you sell.

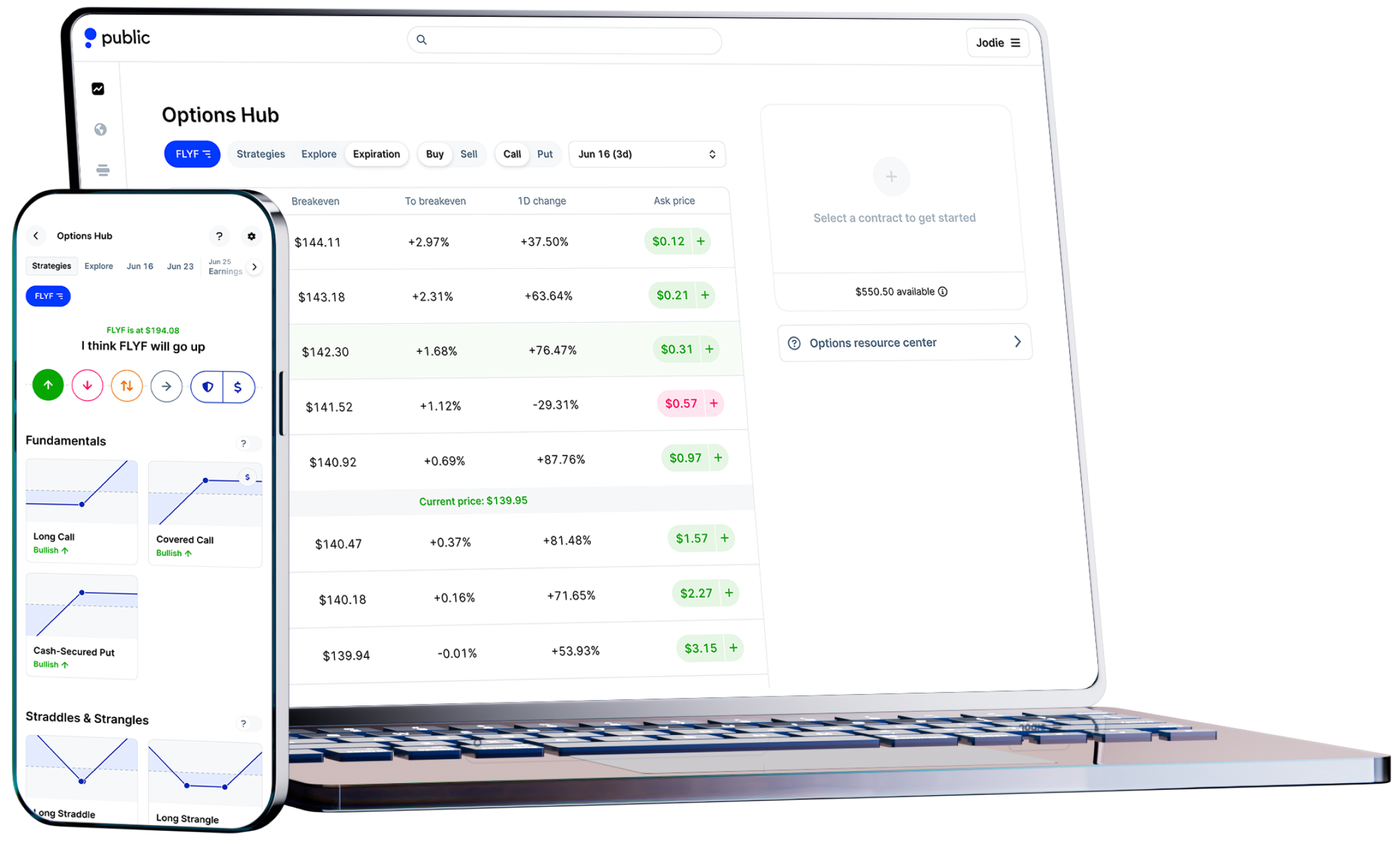

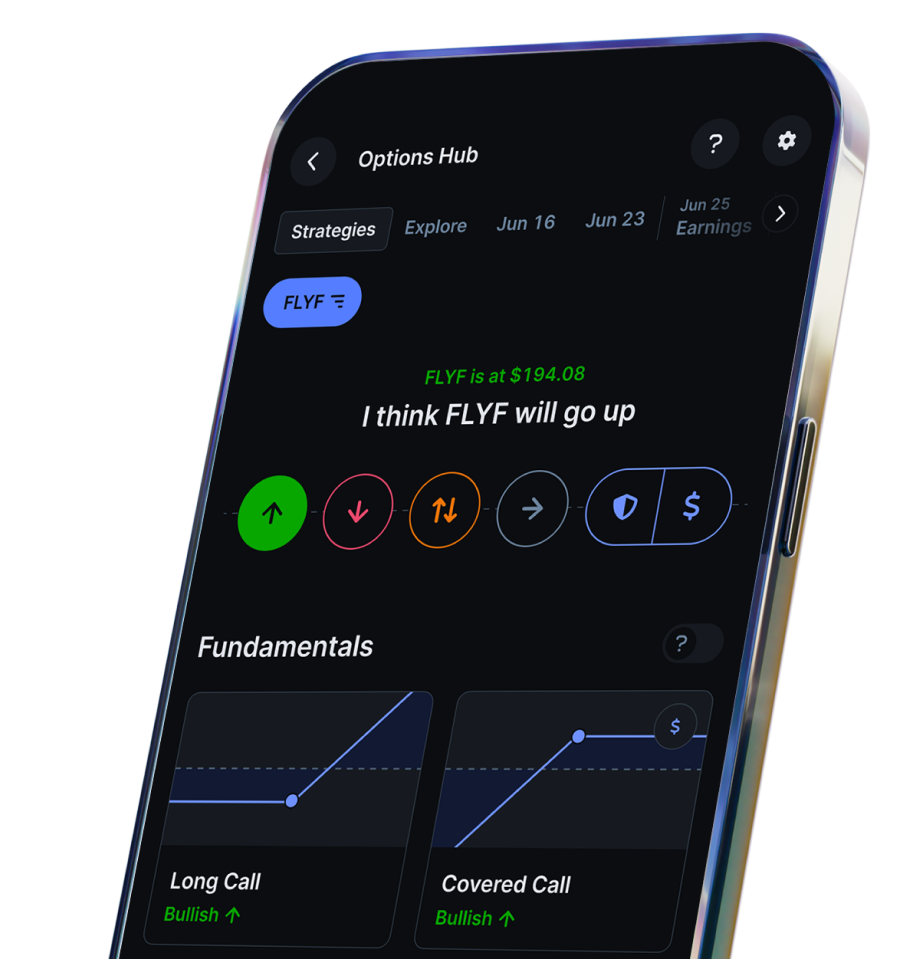

What options strategies are available on Public?

You can currently trade long calls, long puts, covered calls, and cash-secured puts on Public. Stay tuned for more options trading strategies, including multi-leg strategies, coming soon. We plan to launch straddles, strangles, call debit spreads, call credit spreads, put debit spreads, put credit spreads, long call calendar spreads, and long put calendar spreads.

What is options revenue sharing and how does it work?

At Public, we take a unique approach to options trading by sharing up to 50% of the revenue we generate from payment for order flow (PFOF) with you, the customer. That means not only are there no fees that go to Public when you place an options trade, but you also get a rebate of up to $0.06–$0.18 per contract traded.

Why are options considered riskier than other investments?

Options are considered riskier than many other investments because they are leveraged instruments, meaning that a small investment can lead to large gains or losses. Option prices can fluctuate significantly, and the potential for the total loss of your investment is higher than stocks or bonds.

Have additional questions about Options on Public?

Our US-based customer experience team has FINRA registered specialists standing by to help.